Writing checks used to be a common practice. However, with technological advancements, it has, for the most part, become a thing of the past. Nevertheless, you may still find yourself in a situation where writing one becomes necessary. So whether you need a quick refresher or it’s your first time, check out the steps below.

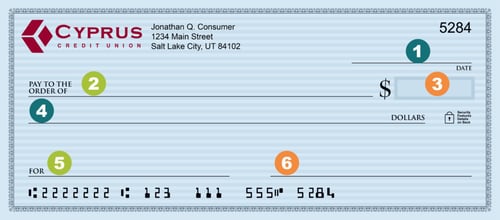

1. DATE

This needs to include the full day, month, and year. Either the full date, February 9, 2017 or just numbers, 2/9/17, are accepted.

2. NAME OF RECIPIENT

Whether you are paying a person, a business, or a group, you must include the full name and make sure that it is spelled correctly. You also have the option of making the check out to ‘cash’ which means anyone can cash it. However, this means if the check gets lost or ends up in the wrong hands, you may lose that money.

3. DOLLAR AMOUNT

Write this out as the exact amount you owe. Nothing needs to be rounded up or down. So if you need to make a payment of 123.15, that's what you write.

4. WRITTEN OUT DOLLAR AMOUNT

Using the example above, in this space you would write one-hundred and twenty three dollars and 15/100. If there is no cents, simply write none/100. If the situation arises where the dollar amount differs from the written amount, the written amount will be honored at the time of deposit.

5. MEMO

This is the only part that is optional to fill out. Most people use this space for the reason the check is being written. For example, this could be things like ‘babysitting,’ ‘cable bill,’ or ‘haircut.’ If you are paying a bill to a business where you have an account number, this should be included on the memo line in case the check is separated from your information.

6. SIGNATURE

Finally, the most important part of writing a check is signing it. Any check without a signature is invalid. Do not sign on the back. This space is for the recipient to sign when they deposit the check.

Cyprus Dream checking accounts have no minimum balance requirements, no monthly or annual fees and no per-check charges. Also, any positive balance will automatically earn interest. You may also be eligible for overdraft protection. If you are interested in opening an account with us, stop by any of our branches or check out our website.